CASE STUDY: Driving Software Sales Through Hyper-Targeted Media

Using Seasonality and Competitive Intelligence to Increase Sales

About

- Microsoft’s Office for Mac has been the primary software product for their Macintosh Business Unit.

- Each year, co-operative promotions with retailers focus on driving sales during the holiday shopping season.

Challenge

- Develop a digital media strategy driving supplemental product sales with featured retail partners and software trials.

- Adhere to strict brand parameters and avoid competing with the retailer’s efforts.

Approach

- Leverage competitive research to identify key opportunities.

- Execute a hyper-targeted digital campaign based on specific seasonal trends.

Results

Details

Microsoft’s Office for Mac has been one of the most successful productivity suites available to Mac users. Widely used by businesses and individuals alike, its functionality bridges the gap between Mac and PC users with Mac-compatible versions of Word, Excel, PowerPoint and Outlook. Throughout the year, Microsoft supports retail sales through various seasonal marketing strategies and engaged Media Two for development and execution of their digital initiatives.

Traditionally, one of the largest promotions has been during the holiday shopping season. Software sales are a particularly difficult vertical to support during the holidays. In addition to overcoming the challenge of increased competition for media inventory, retailers typically focus on promoting higher-ticket items such as electronics, entertainment, toys and home goods. Software is often a secondary or complimentary purchase to a desktop computer, laptop or tablet.

Our primary KPIs were to drive sales through online retail partners as well as supplemental purchases through a direct trial of the product with Microsoft. The specific brand parameters surrounding the media campaign included:

- Advertising should equally support four featured retailers driving directly to an online point-of-sale.

- Media placements should not compete with any advertising efforts placed directly by those retailers.

- And advertising supporting the trial-to-purchase cycle should not compete with any ads placed to support the featured retailers

Specific campaign benchmarks were also set based on experience from the previous years’ performance during the same holiday season. These included purchase events with the retailers, click-to-conversion percentages

and trial volume.

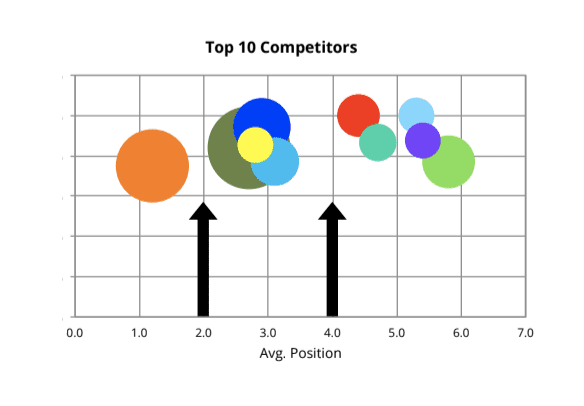

In order to overcome the hurdles of competitive media in market, competitive reporting served to identify specific voids in which we could reach our target audiences. Our search strategy leveraged non-competitive keywords as well as bidding strategies to complement the efforts of the retail partners. The average position of search ads allowed us to add frequency to queries resulting in ads from the partners. For example, the majority of retailers’ ads were showing in either the first or third position. Therefore we could target the second or fourth position with our bids to avoid direct pricing competition and provide additional promotional support for the product.

We overcame similar challenges with display through an effective request for proposal process that identified very specific content placements in which we could guarantee competitive separation.

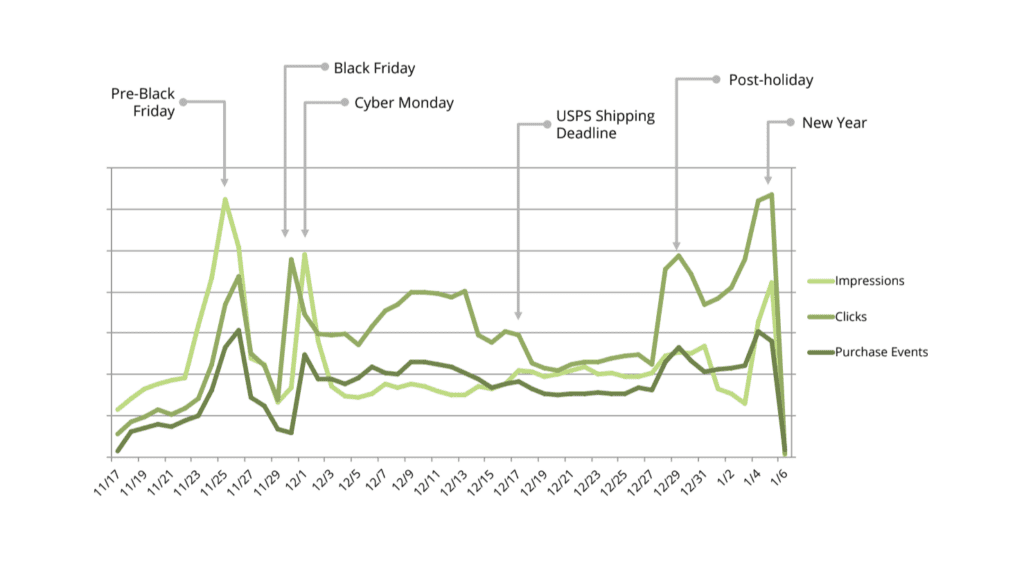

By using historical data, we were able to identify key dates and date ranges for which to scale spending and refine targeting. At the beginning of the campaign our strategies focused on broadening reach in order to determine the most effective opportunities for scalability. Our placement strategies then shifted to lower-funnel tactics to drive higher conversion volume post-click in the specific instances where we knew conversion percentages would be higher.

The pre-Black Friday timeframe served as a testing period for media placements and keyword strategies with the hyper-

targeted elements of the campaign launching on Black Friday. The campaign continued with the spend and targeting

aligning with the seasonal timeframes leading up to the last day of guaranteed shipping prior to Christmas, expected post-

holiday sales the week after Christmas and the first full weekend of the New Year.

The non-competitive media strategy coupled with the strategy to scale spending in alignment with specific campaign

timing resulted in performance metrics that were exponentially greater than expected. We were able to drive increased

entries into the purchase cycle without competing with the retail partners. The fluctuations with the conversion metrics

were consistent with the expected trends.

- 237% delivery on forecasted purchase events.

- 161% increase in conversion percentages from the previous year.

- 630% lift in trial volume from the previous year.